Part of the reason why its so hard to get a credit card without a Social Security number is that its almost impossible to get a credit history much less a credit score for a person who doesnt have the number. Capital One and Citi both offer cards for people without a.

2021 S Best Credit Cards Without Ssn Requirements

2021 S Best Credit Cards Without Ssn Requirements

Applying for a credit card without a Social Security number can be a hassle.

Credit card without social. Apply for an Individual Taxpayer Identification Number ITIN look for a card that doesnt require an SSN or if youre from an eligible country apply for an American Express personal credit card. Some credit cards like the Petal Visa Credit Card or Jasper Cash Back Mastercard are designed to help applicants with no credit history build one without a deposit. Some banks wont issue any credit cards to individuals without a Social Security number or ITIN.

What just happened is you got a credit card without ever using your social security number. The Petal card is designed to help people build their credit history. The Petal 2 Cash Back No Fees Visa Credit Card for example does require applicants to be US.

For example most credit card issuers will ask for an ITIN Individual Taxpayer Identification Number proving that you are a taxpayer. Can you open a business credit card without divulging the company founders social securi. Residents but you can apply with either a Social.

Any that are from Comenity Bank are good ones to try. There are three main options if you want a credit card but dont have a Social Security number. To save time select several cards that meet your businesss needs and before you fill out any online applications call the card issuers to ask if you can apply without a Social Security number.

Completing the paperwork can be time consuming. And you dont need an SSN to qualify. It is possible to open a credit card without an SSN.

It accepts applications from customers with either a SSN or an ITIN. Getting a credit card without a social security number is possible especially if you have an ITIN. The most common form of alternative identification that is accepted is an ITIN however this may vary by issuer or card.

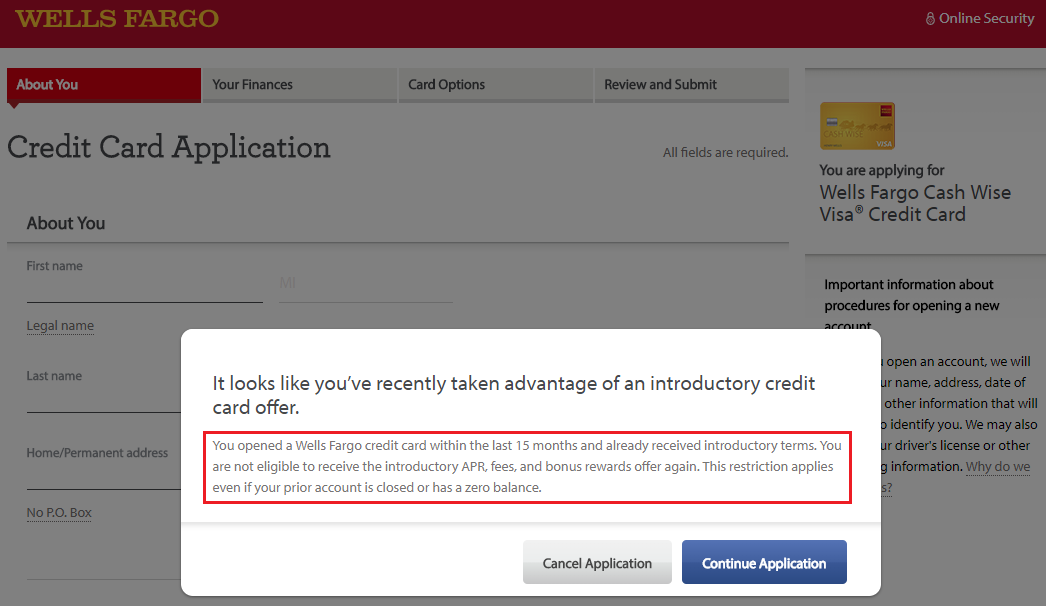

You can then use this form of identification to apply for an Employer Identification Number. Some lenders allow you to apply for a credit card using an Individual Taxpayer Identification Number ITIN or other documentation. Banks heavily rely on your credit score in order to determine your eligibility particularly when it comes to credit cards.

To apply for a business credit card without using a Social Security number you need another form of identification as a substitute. Most card issuers require a Social Security number to ensure your identity. A few examples of places you can try this are Victorias Secret Overstock and Sportsmans Guide.

How to Get a Business Credit Card Without a Social Security Number. Of the seven major credit card issuers that we researched five will allow you to apply for a credit card without an SSN. But some cards on the market allow you to apply using an alternate form of identification such as an ITIN.

8 rows The best credit card without a Social Security number requirement is the Capital One Platinum. If you dont have a Social Security Number you will need other documentation to open a new credit card. American Express Bank of America Capital One Chase and Citibank.

But obtaining an ITIN does not necessarily mean youll get approved. If you dont have either you may have to call the card issuer to apply through a paper application or in-person application process. Since you only put the last four in you wont even get a hard inquiry on your credit report.

With your SSN substitute and your EIN you can then apply for a business credit card. Patriot Act made it almost impossible to activate or even apply for a traditional prepaid card without a Social Security number. Itll be easier to qualify for credit cards if you have an American-based credit history or an.

/cabelas-club-card-cdfa891d46d444d8b99ef6200a297db5.png)