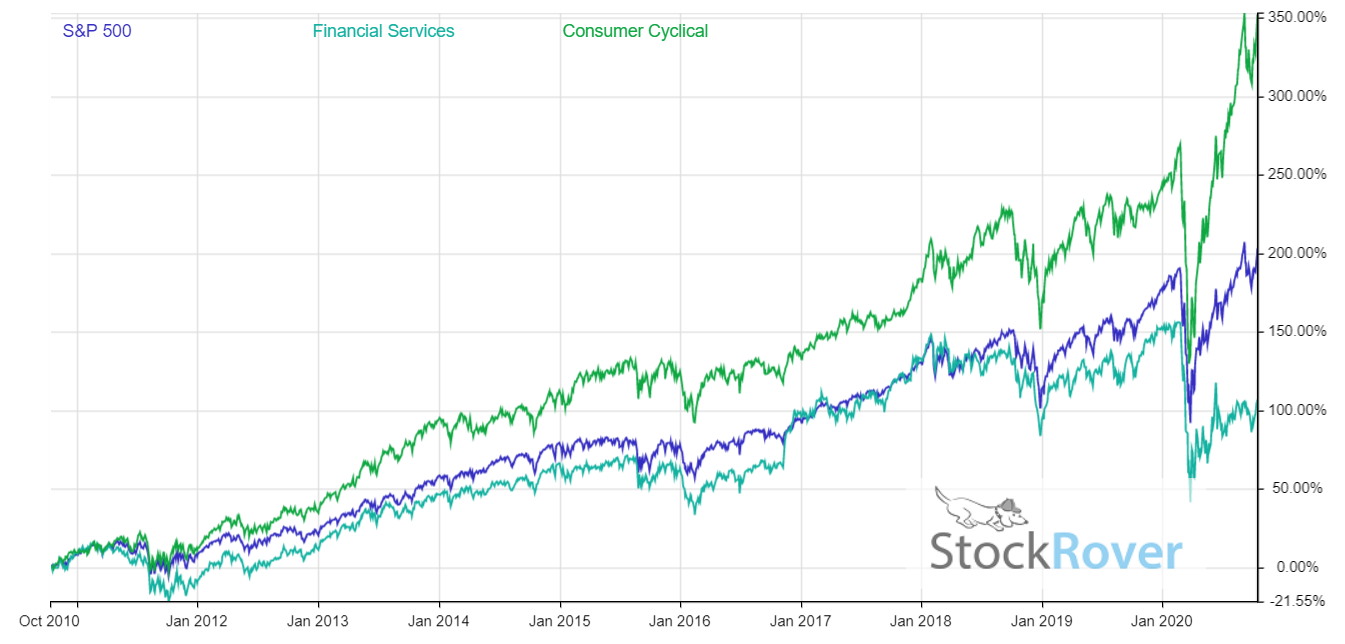

Various bond index strategies like iShares bond ETFs have strong performance within their Morningstar categories across a broad range of sectors. 1097 rows ETF Performance The table below shows comparative Total Return price appreciation.

11 Stock Market Sectors Etf Stock Performance 2021

11 Stock Market Sectors Etf Stock Performance 2021

The Vanguard Utilities ETF VPU rose 115 year-to-date as investors sought out defensive sectors to hide out in amid 2018s market volatility.

Sector etf performance. Performance summary for 2021 and the previous 3 years. Sector power rankings are rankings between US-listed sector ETFs on certain investment-related metrics including 3-month fund flows 3-month return AUM average ETF expenses and average dividend yields. Main Sector Rotation ETF has an MSCI ESG Fund Rating of A based on a score of 606 out of 10.

Shows the top Exchange Traded Funds ranked by highest percent change Advances and lowest percent change Declines. The graphic below compares the VGT ETFs one-year performance against that of potential technology competitors like the Invesco Nasdaq. Sector ETFs 05222021 356 AM ET - Today column is in real-time.

Similar to equity ETFs many bond ETFs have delivered competitive returns across a variety of sectors ranking above median in many categories over the long-term. All ETFs are subject to risk including possible loss of principal. Research the performance of US.

Todays ETF Performance Leaders. 159 rows Select Sector SPDR Fund - Consumer Discretionary. 189 rows List of US Sectors ETFs.

The MSCI ESG Fund Rating measures the resiliency of. Sector ETFs exchange-traded funds give you access to a very small part of the overall market such as energy real estate and health care among others. Otherwise as of previous close.

Though many of these narrowly focused ETFs have the potential to grow you should be equally prepared to experience wide swings in the value of your investmentsincluding potentially large losses. Browse a complete list of Vanguard ETFs including detailed price and performance information. Past performance does not guarantee future results.

Find the latest new and performance information on the markets and track the top global sectors. Highlights ETFs that have unusually large price movement relative to their usual pattern meaning ETFs that are seeing breakouts or abnormally large bull or bear moves. Most recent month-end performance is available in the Performance topic.

Sector SPDRs are subject to risk similar to those of stocks including those regarding short selling and margin account maintenance. Todays ETF Price Surprises. Utilities struggled earlier this year when rising.