Allocating assets among underlying Fidelity funds. Choices ranging from individual stocks.

Schwab Target Index Funds Hidden Gems For Your Ira And 401k

Schwab Target Index Funds Hidden Gems For Your Ira And 401k

Can you hold firm during troubled markets.

Fidelity freedom funds vs vanguard target retirement. The difference between their namesjust one word. The Vanguard fund at one point had substantially lower management fees - last I looked a couple years ago the Fidelity target fund was 083 the Vanguard was 014. The fund invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of 2045 the target year.

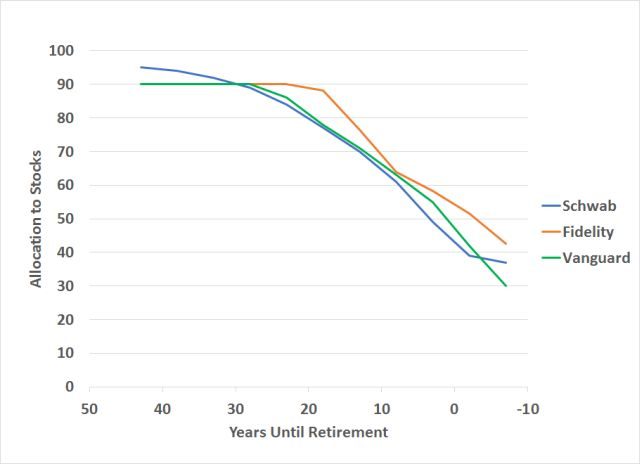

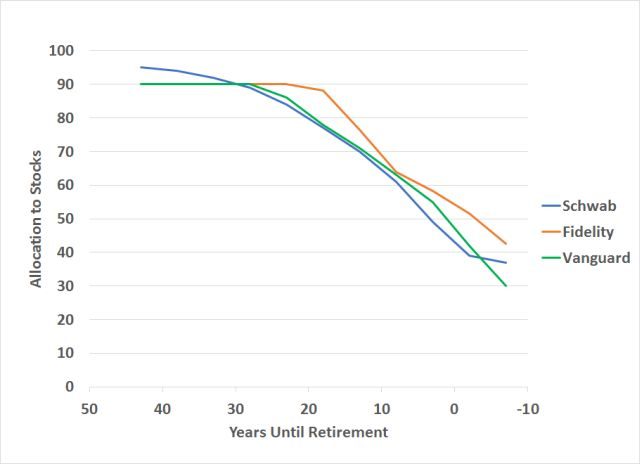

The Average Joe investor out there has so many investment options and choices in 2020. John Hancock Retirement Choices. The funds asset allocation will become more conservative over time meaning that the percentage of assets allocated to stocks will decrease while the percentage of as.

Target Retirement Funds. Both Vanguard and Fidelity are retirement powerhouses their brokers funds line many 401 ks and Fidelity is the leading 401. Investing in a combination of Fidelity domestic equity funds international equity funds bond funds and short-term funds underlying Fidelity funds each of which excluding any money market fund seeks to provide investment results that correspond to the total return of a specific index.

They simplify investment allocation and selection by gradually reducing the level of portfolio risk as the investor nears retirement. It cut expense ratios on the entry level share classes of its target date funds for individual investors known as Fidelity Freedom Index Funds to 12 basis points from 14 as of June 1. More choice than EVER BEFORE.

Vanguard offers target-date retirement funds that hold various stock and bond index funds. Fidelity funds offer a higher tracking precision to their benchmarks than Vanguard but the authors note the difference is small as Vanguards average tracking error is 008 and Fidelity. Fidelity Freedom funds are best suited for investors who not only want to save for retirement but also to stay invested during retirement.

These funds require a 1000 minimum investment which makes it easy to diversify your portfolio as a new investor quickly. Theres one thing to get clear right upfront. The Vanguard Target Retirement 2060 Fund charges an expense ratio of just 15 basis points.

It provides three types of target-date funds which can be distinguished by the type of underlying funds each invests in. Designed for investors who anticipate retiring in or within a few years of the funds target retirement year at or around age 65. The Vanguard Target Retirement Funds for example charge an average of 017 which is the weighted average of the expense ratios of the funds within the target-date fund.

Another concern with target-date funds is the funds. The composition of the two funds are similar not identical. The funds asset allocation will become more conservative over time meaning that the percentage of assets allocated to stocks will decrease while the percentage of as.

If all three funds charge 05 per year and the target-date fund also charges 05 per year the investor ends up paying extra in total fees. These funds are built around target retirement dates such as Fidelity Freedom 2020 fund Fidelity Freedom 2030 fund and other comparable funds. The Fidelity Freedom 2055 Fund FNSDX 044 is based on active management.

Fidelity Freedom Funds invest in primarily actively managed funds. The Fidelity Freedom Index Funds different from the Fidelity Freedom Funds listed above are another low-cost alternative. Currently it allocates.

However the average expense ratio is 013 which is lower than Fidelity. Fidelity has Asset Manager funds with a similar approach. Vanguards line of retirement funds offer excellent diversity at a low cost.

The fund invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of 2025 the target year. The Fidelity Freedom Index 2055 Fund FDEWX 022 uses indexing. Apparently now the Fidelitys fund expense ratio is 015.

Another twist on the target-date approach is to invest according to your risk tolerance.