Online Savings Account. People seeking longer loan terms or who.

The Best Online High Yield Savings Accounts Of May 2021

Earn every day - interest compounds daily.

Marcus online savings rate. Start saving right away. Marcus savings rate is 050 which is much higher than the national average APY of 006. In addition Marcus also cut rates on nine of its CDs.

Marcus offers a high competitive rate on their online savings account. The 12-month term CD offers one of the best rates on the market. Extreme about no fees and this accounts Quick View lets you see your balance without logging in.

Committed to helping customers reach their financial goals. You can protect and grow your savings in a high-yield account thats FDIC-insured and backed by the financial expertise of Goldman Sachs. UK call centre open Monday to Friday.

Marcus charges no fees to open a Marcus savings account and no ongoing. Grow Your Savings with an Online Savings Account Get an award-winning Marcus Online Savings Account with a rate that provides 4X the National Average. Longer terms offer higher APYs.

040 tax-free variable Save tax-free with no fees or charges interest is calculated daily and paid monthly. Marcus interest rates and fees As of publishing Marcus offers fixed APRs ranging from 699 to 1999. Marcus Online Savings Account rate was reduced by 10 bps to 215 APY.

You can only pay into one cash ISA each tax year. This competitive interest stand-alone savings account is also fee-free. Marcus by Goldman Sachs is an online bank that offers a high-yield savings account.

Annual Percentage Yields APY as of May 07 2021. The minimum to open is 500. Learn more about our High Yield Savings Accounts.

The Marcus online savings account offers high yieldsconsidering todays savings rate environmentcurrently earning 050 APY. All rates went down by 10 bps. 040 AERgross variable Interest is calculated daily and paid monthly into this account.

Just three days after Ally Bank cuts the rate of its savings account Goldman Sachs Bank USA Marcus has done the same thing. Gross is the interest rate payable before tax is deducted. 050 APY variable Access.

There are no service fees. 5 deposit gets you membership at the only credit union on our list. APY may change at any time without notice before a CD account is opened and funded.

Theres no minimum deposit to open the account. This illustrates what the interest rate would be if interest was paid and compounded once a year. Joint account available you can open an account with an existing Marcus customer or someone new although you cant currently change a sole account to a joint account.

AER stands for Annual Equivalent Rate. Marcus by Goldman Sachs provides no-fee personal loans high-yield online savings for individuals. You can make withdrawals but any money you take out cant be replaced within your annual ISA allowance.

There is no minimum to open and you only need 1 to earn the stated APY. Theres no minimum deposit for the Marcus Online Savings Account. While you can find higher APYs elsewhere youll still enjoy a very competitive rate.

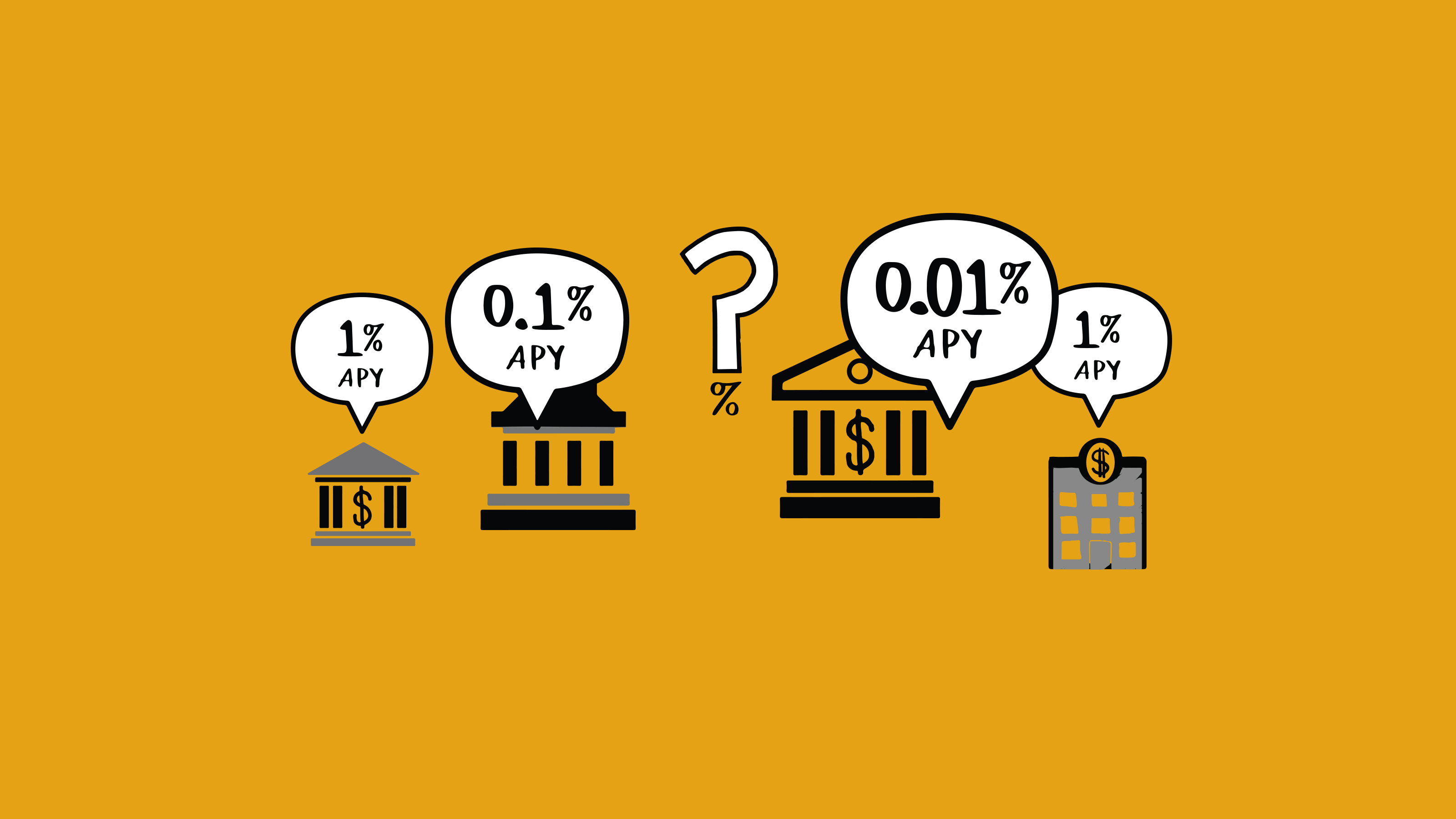

627 - Marcus Cutting Online Savings Rate From 225 To 215 37 - Goldman Sachs Bank USA Offers 100 Online Savings Account Bonus 37 - Marcus Goldman 100 Bonus With 10000 Deposit 225 APY 14 - Goldman Sachs Bank USA Ups Rates On Online Savings Account and CDs 14 - MarcusGoldman Sachs Raises Savings Rate To 225. Marcus by Goldman Sachs Online Savings Accounts annual percentage yield APY is much higher than youll find at most brick. Maximum limits per depositor andor account apply.

Premium Online Savings Account. The fixed rate saver meanwhile offers the following.