Paying bills on time every time. For example most credit cards come with rental car insurance allowing you to decline the costly optional policies offered by rental car companies.

How To Use Credit Cards To Build Credit

How To Use Credit Cards To Build Credit

Set up automatic monthly bill payments from a bank account.

How to use a credit card wisely to build credit. Building credit can be tricky. Simply by using your credit card periodically and paying off the balance each month you can build credit over time. To work your way toward excellent credit scores focus on making on-time payments and avoid maxing out your card.

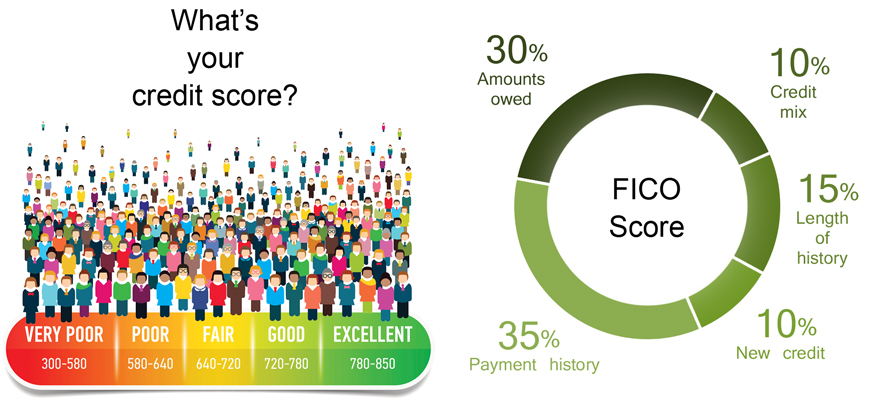

If you have two credit cards with a total limit of 2000 your credit utilization would be 50. Do not try to get multiple credit cards in a short amount of time. Building credit takes time theres no way around it but using a credit card responsibly is one of the fastest ways to build credit.

Use less than 30 of your credit limit ideally 1-10. Here are the key takeaways of using a credit card responsibly. But to do that the outstanding.

Many credit cards also include extended warranty coverage so you dont have to pay for an. For example if you have a card with a 5000 credit limit and the. Pay your full balance by the due date to save on interest too.

Pay Your Bill on Time. Becoming an authorized user on someone elses credit card is a great way to build credit without taking a chance on responsible credit card use. However if youre wondering how to use a credit card to build your credit here are some answers.

Save my name email and website in this. But a credit card will only help you if you use it responsibly and in the right situations. Summing Up Building Credit With Credit Cards.

Generally speaking your credit utilization should never be more than 30. Build your credit rating. In some circumstances it may be possible to increase your credit score by as much as 100 points within 30 days.

Become an authorized user on a family members card to build credit faster. Using a secured credit card is perhaps the quickest and easiest way to build credit as long as youre smart about how you use it. The key is to keep balances low and pay on time every time.

To build credit with your credit card make at least your minimum payment on time every month. To build credit with your credit card make at least your minimum payment on time every month. Simply get one card use it wisely and be patient.

You can help build your credit with responsible use of a card like this. Be automatically considered for a higher credit line in as little as 6 months. Using just a small percentage of your available credit even when you pay it off in full each month.

Keep your balances on credit cards as low as possible. The cash back hotel points airline miles or other benefits of credit card use can be substantial. To calculate your credit utilization ratio add up the balances on your cards and then add up your credit limits.

For example if a card user makes a purchase right after the credit card bill is generated heshe can enjoy up to 45 interest-free days in some cases even more. Here are the best ways to use your credit card to your benefit. The best practice is to pay off your credit cards every month.

If you miss your bills due date the card issuer may charge you a fee and you could lose any introductory or promotional interest rates on your account03-Jun-2020. Heres how to build credit with a credit card. And those formulas for good credit are pretty simple.

To use a credit card wisely you also need to have the tools to put you in the drivers seat. But if youre rebuilding your credit score or starting from scratch it can be difficult to get approved for a credit card in the first place. Become an Authorized User on Someone Elses Credit Card.

It can be tempting to have a line of credit available at any time and not use. Beyond merely using your credit cards responsibly using them wisely includes taking advantage of cardholder benefits that come with your card. See application terms and details.

Credit cards can be a valuable tool in building up your net worth and strengthening your personal financial situation. Leave a Comment Cancel reply. Successfully managing a mix of credit types such as open-ended accounts like.

Divide your total credit card balances by the total credit limits and multiply by 100. Pick the monthly due date that works best for you. Stay conservative with the number of credit cards youre utilizing in order to use your credit cards wisely.

Use WalletHub to monitor your credit. Using credit cards is one of the best and quickest ways to build credit. Your credit utilization rate should be 30 or less on the total credit available Save more every month.

Apply for a secured credit card or a starter credit card. And once you do have a credit card its easy to damage your credit score and make it worse than before you started. If youre starting from no credit know that it could take between three and six months to build.

The most important factor in your credit scores is payment history. While many people have received tons of benefits from credit cards there are plenty. When it comes time to make a big purchase such as a car or a house the credit you built by using your card will come in handy with a nice credit score.

For instance if you have a credit card with a credit line of 1000 and are using all 1000 of it you are at 100 utilization.

5 Ways To Use Credit Cards Wisely

5 Ways To Use Credit Cards Wisely

How To Use Credit Card Wisely Updated 2021

How To Use Credit Card Wisely Updated 2021

Using Credit Cards Wisely Fidelity

Using Credit Cards Wisely Fidelity

How To Rebuild Your Credit Using Credit Cards Wisely

How To Rebuild Your Credit Using Credit Cards Wisely

How To Use A Credit Card Responsibly Business Case Studies

How To Use A Credit Card Responsibly Business Case Studies

How To Use A Credit Card Wisely Self

How To Use A Credit Card Wisely Self

How To Use A Credit Card Wisely Self

How To Use A Credit Card Wisely Self

How To Use A Credit Card Wisely Your Aaa Network

How To Use A Credit Card Wisely Your Aaa Network

How To Use Your Credit Card Wisely To Build A Good Credit Score

How To Use Your Credit Card Wisely To Build A Good Credit Score

5 Tips To Use Your Credit Card Wisely And Build A Good Credit Score

5 Tips To Use Your Credit Card Wisely And Build A Good Credit Score

Use These Tips On How Using Secured Credit Card Wisely Can Help You Establish Healthy Credit Wh Business Credit Cards Credit Card Infographic Miles Credit Card

Use These Tips On How Using Secured Credit Card Wisely Can Help You Establish Healthy Credit Wh Business Credit Cards Credit Card Infographic Miles Credit Card

How To Use A Credit Card To Build Credit Credit Score Credit Card Build Credit

How To Use A Credit Card To Build Credit Credit Score Credit Card Build Credit

How To Use A Credit Card 5 Ways To Build Credit Wisely Cardrates Com

How To Use A Credit Card 5 Ways To Build Credit Wisely Cardrates Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.