Credit Karma Savings is a high-yield savings account that currently comes with a 030 APY as of February 2021 which is significantly higher than the. Those are terrific terms.

Credit Karma Launches High Yield Savings Account

Credit Karma Launches High Yield Savings Account

Credit Karma Savings offers a generous 030 APY and the company says it will leverage technology to keep its rates competitive.

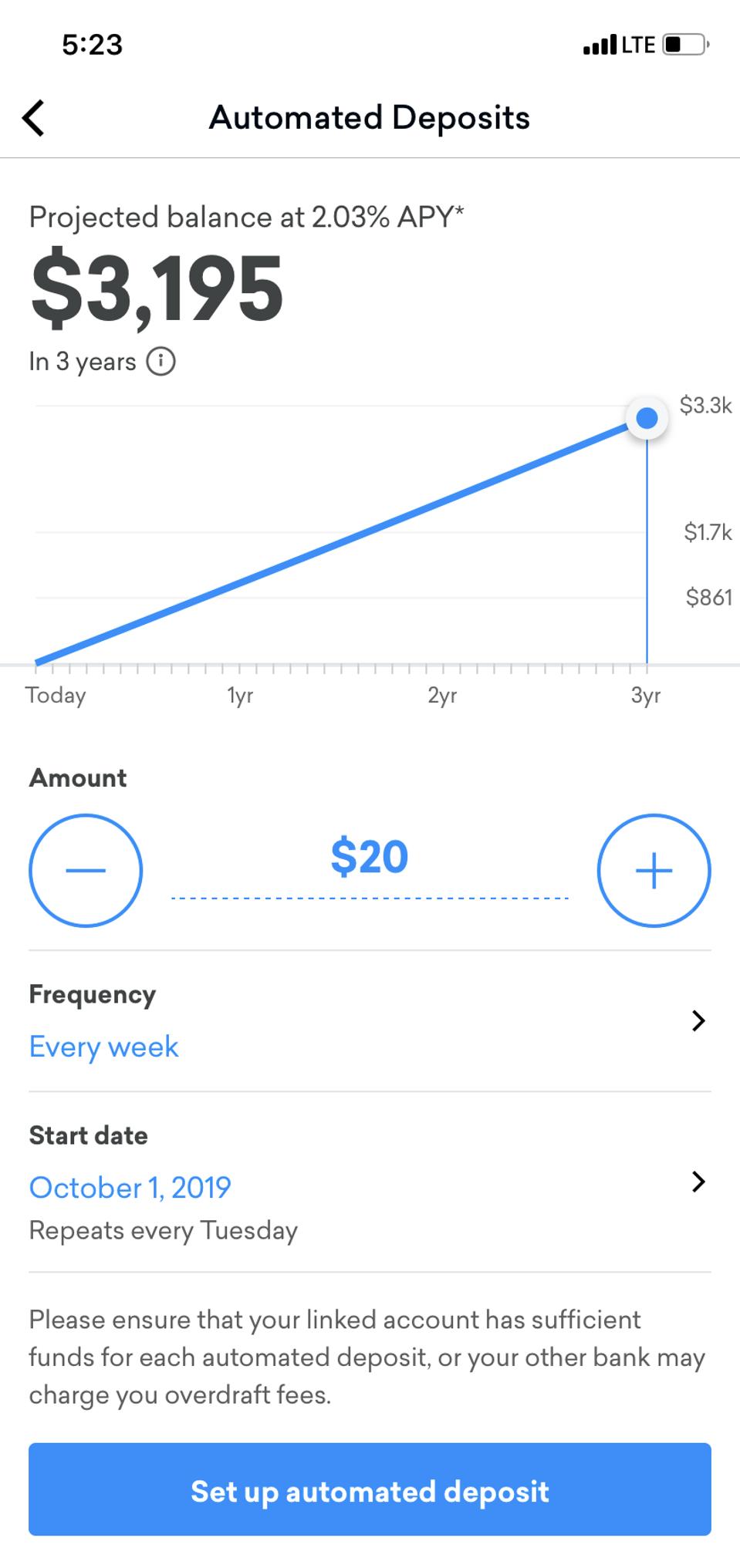

Credit karma savings interest rate. Credit Karmas new savings option which will not charge any fees and does not require a minimum deposit to open is set to offer a savings rate of 203 APY. No check or direct deposits. The interest rate on a savings account or checking account can change based in part on what the Federal Reserve does.

For example you could receive a loan of 6000 with an. Shop Credit Cards Balance Transfer Cards Reward Cards Travel Cards Cash Back Cards 0 APR Cards Business Cards Cards for Bad Credit Cards for Fair Credit Secured Cards Search Credit. As of January 2021 Credit Karma Money Save offers 030 APY.

Offers provided to customers who originated via a paid Google or Bing advertisement feature rate quotes on Credit Karma of no greater than 3599 APR with terms from 61 days to 180 months. Credit Karma is completely free but you must have an existing account to open a Credit Karma Money Save account. What is Credit Karma Money Save interest rate.

For example you could receive a loan. Continue reading below to learn everything you need to know about Credit Karma. For example you could receive a loan.

Available for residents nationwide Credit Karma is offering a High Yield Savings 040 APY account. 2 Zeilen The interest rate is what the bank will pay you for the privilege of keeping your money. Thats over 22 times the average rate.

Funds deposited into your Credit Karma Money Save account are FDIC insured and connections to external accounts are made via the secure API Plaid. Credit Karma High Yield Savings Here is your opportunity to earn a an interest rate of 040 APY on your funds. Offers provided to customers who originated via a paid Google or Bing advertisement feature rate quotes on Credit Karma of no greater than 3599 APR with terms from 61 days to 180 months.

Your actual rate depends upon credit score loan amount loan term and credit usage and history and will be agreed upon between you and the lender. Deposit 1 each month for a chance to win a 20000 savings boost. But with the Federal Reserve cutting interest rates high-yield savings rates are harder to find.

Credit Karma savings offers an APY of 040 APY stands for annual percentage yield rates may change. Credit Karma is the latest fintech firm to launch a high-yield savings account. Heres how Credit Karma Savings works and what to consider.

Open a new account and start earning interest and get started today. Credit Karma is partnering with a network of banks to hold your deposits and gain Federal Deposit Insurance Corporation FDIC insurance. While its higher than the national average of 004 youll find higher rates with other savings accounts like Chime or Axos High Yield savings which earns 061 APY.

Offers provided to customers who originated via a paid Google or Bing advertisement feature rate quotes on Credit Karma of no greater than 3599 APR with terms from 61 days to 180 months. Credit Karmas high-yield savings account is big news for consumers who. Credit Karma is offering an APY of 056 which is roughly 6x higher than the average national rate which is currently 009 for savings accounts.

Table of Contents hide 1 Credit Karma High Yield Savings Review. Your actual rate depends upon credit score loan amount loan term and credit usage and history and will be agreed upon between you and the lender. Your actual rate depends upon credit score loan amount loan term and credit usage and history and will be agreed upon between you and the lender.

As of early October 2020 Credit Karma Savings offers a 040 APY which is much higher than the average savings rate of 005 according to the FDIC. Deposit 1 each month for a chance to win a 20000 savings boost.