In other words a prepaid Green Dot card allows you to pay bills buy stuff online withdraw money from ATMs and cash checks among other things. GDOT is a financial technology and registered bank holding company focused on making modern banking and money movement accessible for.

Manage Your Money Closely With A Prepaid Card

Manage Your Money Closely With A Prepaid Card

Cards issued by Green Dot Bank Member FDIC pursuant to a license from Visa USA Inc.

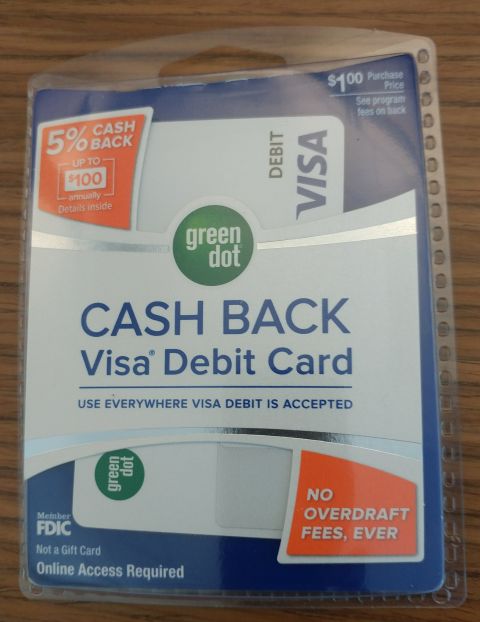

What is a green dot prepaid card. You can order Green Dot Visas or MasterCards online for a 995 fee or buy them from thousands of retailers called Sales Agents. The Green Dot Reloadable Prepaid Visa is designed for consumers who want the convenience of paying with plastic but dont want or dont qualify for a regular credit card. Green Dot Cards are issued by Green Dot Bank Member FDIC pursuant to a license from Visa USA Inc.

GoBank Green Dot Bank and Bonneville Bank. For those who dont know Green Dot is a payments platform company that specializes in. You will be required to fill out a form that includes your social security number.

Our ever-growing retail network of 90000 locations allows you to deposit funds nationwide. The Green Dot card is an FDIC-insured reoladable prepaid debit card that can be used to make payments and purchases and withdraw cash. They can be used wherever Visa or MasterCard is accepted.

Its website states the following fees but more charges may apply based on how you use the card. Green Dot is a leading provider of prepaid debit cards and secured credit cards and theyre hugely popular thanks to their convenience and simplicity. Green Dot Prepaid Cards are reloadable debit cards that serve as an alternative to traditional bank accounts and let you load your paychecks.

A Green Dot card is a prepaid debit card thats issued out by Green Dot. Prepaid cards only allow you to spend money already in your account. Up to 7 cash back Prepaid cards are not available for purchase in VT.

Track your spending 247 shop online pay bills and make everyday purchases. The Green Dot Prepaid Card has a 10000 maximum balance limit a 3000 daily spending limit and a 400 daily ATM withdrawal limit all of which are onpar with other prepaid cards. Green Dot cards are sold at retailers such as CVS Rite-Aid.

See I was issued a Turbo tax visa card through green dot in order to get my tax money well in order to secure a advance through turbo tax. Visa is a registered trademark of Visa International Service Association. The Green Dot Prepaid Visa Card gives you access to 247 banking mobile check deposit earlier paydays no bank transfer fees lockunlock protection and a range of other options.

So you can avoid. The Green Dot Prepaid Visa card lets you make direct deposits onto your card for free. I started a dispute with them and waited for a reply.

That means you can have your paycheck tax return government benefits or other regular or irregular payments sent directly to the prepaid card without being charged for the transactions. As noted above Green Dot cards function similarly to debit cards without requiring an existing bank account. Prepaid Visa Debit Card Green Dot Green Dot Prepaid Visa Card Sold only in stores Use everywhere Visa debit is accepted in the US.

Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names. If you have a new Green Dot card.

GO2bank GoBank and Bonneville Bank. Green Dot cards are prepaid debit cards that you purchase. PLUS with the Vault feature you can set aside money for something special or set up an emergency fund.

Green Dot Bank also operates under the following registered trade names. Deliver trusted best-in-class money management payment solutions to our customers partners seamlessly connecting people to their money.