Process People Parent Price and Performance. Each year we rate plans across five key pillars.

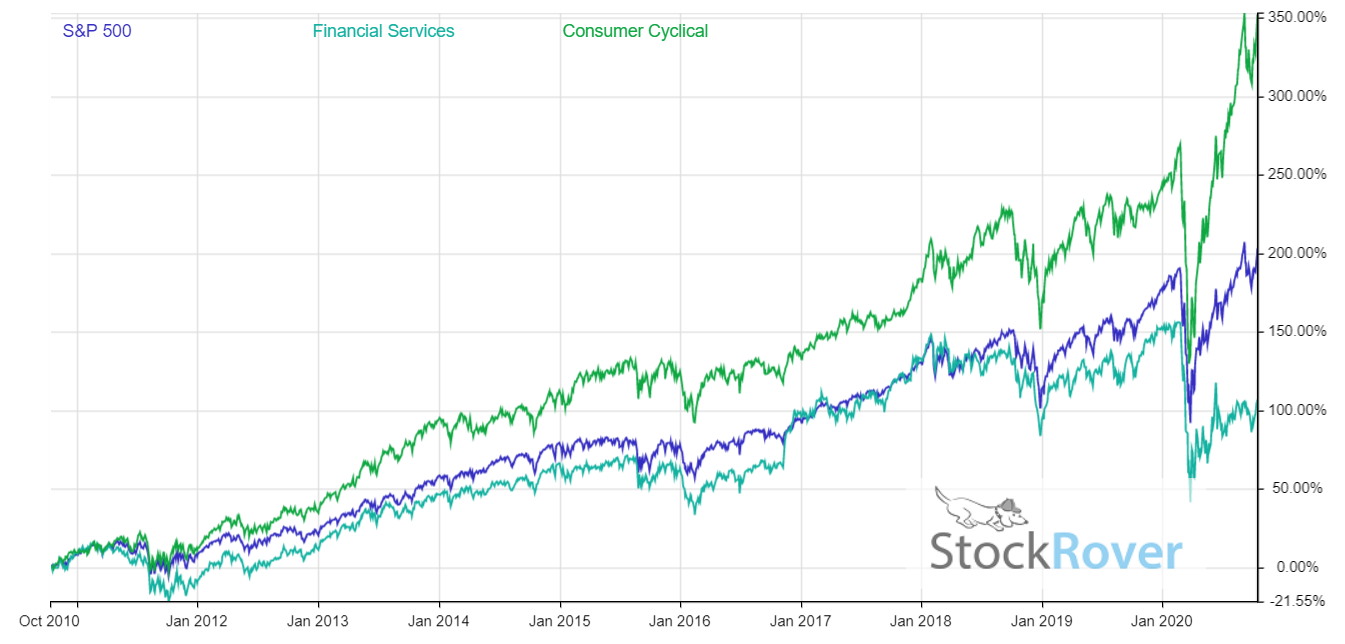

Q1 2021 529 Plan Rankings Ten Year Performance

Q1 2021 529 Plan Rankings Ten Year Performance

Lowest fee 529 plans of 2021.

529 performance rankings. In producing our rankings we compared the reported investment performance of a subset of portfolios from each 529 savings plan. Process People Parent Price and Performance. This ranking could be a useful tool for you.

Additionally Ohios 529 Plan was ranked third in the nation in the one-year category and sixth nationwide for the best performance in the three-year category. 57 rows The performance score determines the ranking. 57 rows The performance score determines the ranking.

Some states have different fees for residents vs. Five year and ten year. The 5-Cap Rating is not strictly a measure of historical returns and it is not a predictor of future investment performance level of.

Pillar-level research informs our holistic view of plans and results in the Analyst Rating for 529 plans a five-tiered scale that from highest to lowest conviction includes three Morningstar. The 5-Cap Rating represents our analysis of the overall usefulness of a states 529 plan based on many considerations. The top-performing 529 plans.

This ranking could be a useful tool for. In October 2019. Although ratings for 529 plans use the same scale as the Morningstar Analyst Rating for mutual funds the 529 ratings reflect the quality of.

We assign a rating to each state-sponsored 529 plan ranging from one cap least attractive to five caps most attractive. For most parents looking for a way to save for their childs college education a 529 college savings plan is a wise choice. Best rated 529 plans of 2021.

10 rows 529 Plan Rankings Q4 2020. We include both direct-sold and broker-sold 529 plans. These plans have the best performance based upon a moderate-risk age-based.

Non-resident expense ratios are always used so please check with your state plan to see if they offer a resident discount. Strong performance of investment choices matched by other 529 plans Age-based configurations charge between 014 and 052 in management fees with an. Find the Forbes Advisor list of the Best 529 Plans available to you.

National trends influence 529 plan ratings by state. Morningstar analysts carefully evaluate 529 plans and assign Morningstar Medalist ratings based on their scores in five key areas. 49 states and the District of Columbia offer 529 plans.

You may view a 529 plans ranking within a particular asset-allocation category eg. As of December 31 2019 CollegeAdvantage Direct 529 Plan ranks first in the nation for the best investment performance in two different categories. 100 equity or on an overall composite basis.

These plans have the lowest total expense ratio based upon a moderate-risk age-based portfolio for a newborn. Morningstar Analyst Ratings for college savings plans are back in session.