Comparison of IPSS for Efficacy Time Frame. With 12-month follow-up prostatic urethral lift improved IPSS scores by 10 points with a quality-of-life improvement of 2 points with no worsening of erectile function on IIEF-5.

Urolift Peer Reviewed Clinical Results Fda Cleared

Urolift Peer Reviewed Clinical Results Fda Cleared

Unfortunately objective results were not as robust as Qmax improved only by 34 mLs and in no individual study did the flow rate improve to 15 mLs or greater.

Urolift success rate. For men who are less than ideal candidates for the Urolift procedure and decide to have the Urolift procedure success rates are typically less than 90. Maximum MR system reported whole body averaged specific absorption rate SAR of 4 Wkg First Level Controlled Operating Mode Under the scan conditions defined above the UroLift Implant is expected to produce a maximum temperature rise of 24C after 15 minutes of continuous scanning. We just completed a clinical trial showing that UroLift works well for these men too.

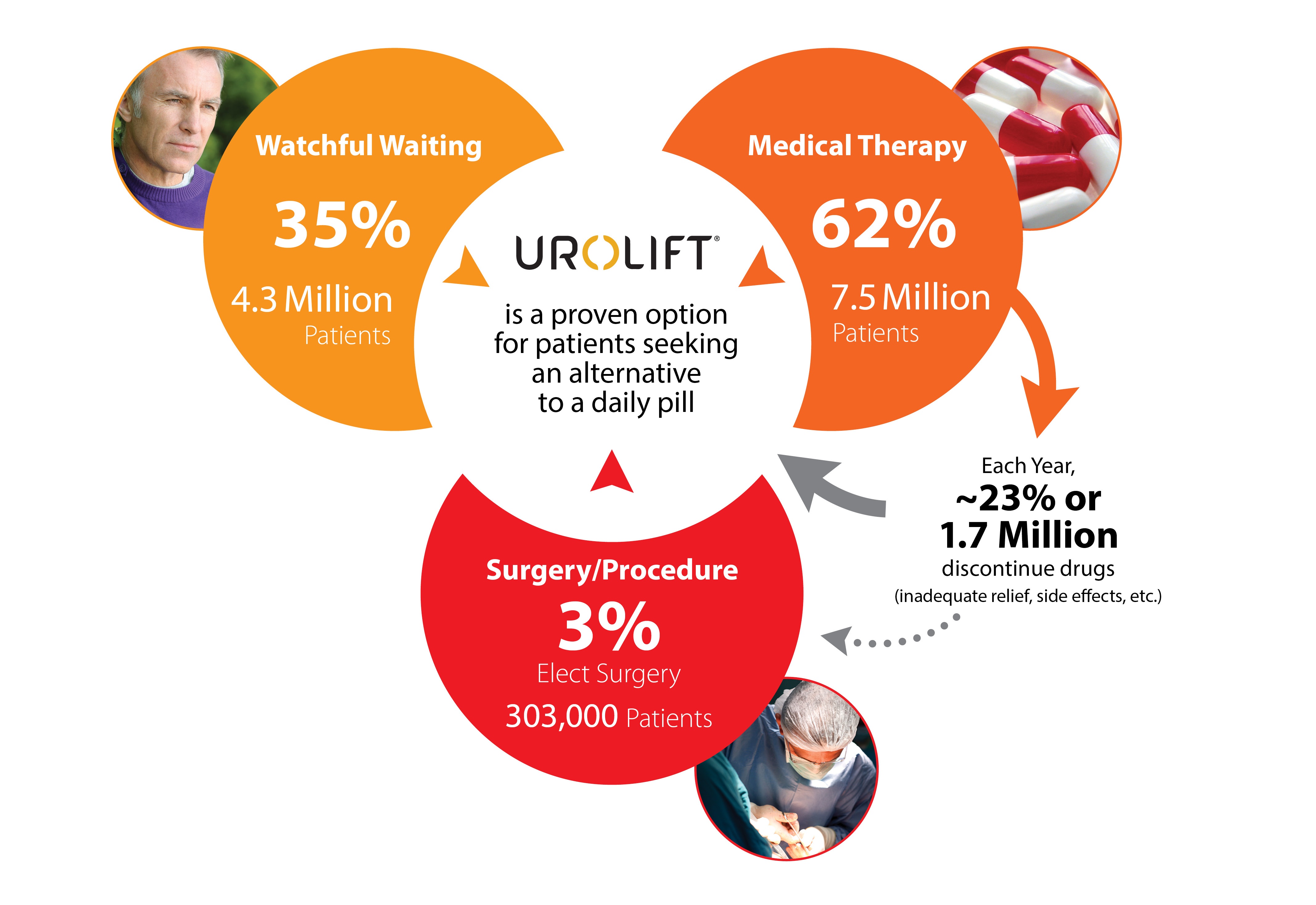

In men treated with Urolift 50 showed improvement in flow rate twice that of drugs but less than after TURP or HoLEP 50 improvement of reported symptoms up to 2-3 times better than drugs but less than TURP or HoLEP No sexual dysfunction always some degree of dysfunction following other surgeries. Discover How Millions of Men Treated An Enlarged Prostate Successfully. Most surgeries will require recovery and healing time.

Urolift is a minimally invasive procedure for the management of BPH. At 1 month 80 percent of men 95 CI 66- 89 percent reported being much or very much better and 89 percent 95 CI 76-95 percent would recommend the procedure. Like I said only just over 3 weeks but seemed to be healing quickly.

The urologist inserts tiny implants through the urethra that move the enlarged prostate out of the way. Under 10 of study participants experienced any actual side-effects. Thats the massive negative as really hoped to get better sleep.

I indeed didnt know urolift only has a success rate of only 60. As far as the UroLift procedure is concerned the urinary function is improved by about 30. There are some key differences between these two and we hope this comparison will help you decide which one is the right choice for you based on your lifestyle and priorities.

During the procedure which takes less than an hour the patient is given mild sedation. There have been studies conducted which have evaluated the UroLift system. I am shocked of such low rate.

Bother due to ejaculatory function improved rapidly and remained modestly improved at 1 year p0001. Twelve-month data from the multicentre prospective MedLift study of the Urolift system NeoTract a Teleflex subsidiary for benign prostatic hyperplasia BPH involving a median lobe obstruction provided clinical evidence to support the safety and efficacy of the treatmentResults were published in Prostate Cancer and Prostatic Diseases. About a third of men with BPH also have whats called a median lobe or a bit of prostate tissue that protrudes up into the bladder.

That and less of the stop and start peeing. It may not be right for all men. Both Urolift and TURP are surgical procedures used to treat urinary problems caused by an enlarged prostate.

The side effects of the Urolift procedure are in most cases temporary and usually last up to two weeks or less. The urinary function is improved after both TURP and UroLift procedures. This system has had considerable success in the last few years since it came out.

Patients are mostly very happy with the results and have experienced minimal side effects from the procedure. A study was conducted over 36 months involving Urolift patients. It is notable that after the TURP procedure 3 of the patients will experience SUI stress urinary incontinence and 7 will experience urinary stricture.

It helps reduce the prostate swelling that inhibits the flow of urine from the urethra. The UroLift system is a non-invasive way of addressing BPH. Readers who are thinking of doing urolift may want to know my reputable uro just told me that the reoperation rate for urolift is 33 within 3 years or 5 years my memory is vague.

Certain factors such as a large prostate over 100 gram. 3 month The UroLift system will be considered superior to the Control if the mean International Prostate Symptom Score IPSS change improvement from baseline at 3 months demonstrates a minimum statistical margin of 25 compared to mean improvement from baseline for cystoscopy alone. But my view is that UroLift works best in prostates ranging from 25 to 60 grams.

The positive is sex has improved which is great as was suffering with ED which is actually a massive deal for me as would think for any male. Regardless of the success rates most surgical procedures naturally come with potential side effects and complications. The Urolift procedure claims to be a safe one but any treatment or procedure comes with some risk even if that risk is minimal.