For example a bank might charge 35 monthly for you to hold an account. Qualification for the Preferred Rewards program tiers is based on having an active Bank of America personal checking account and maintaining a three-month average combined balance across your Bank of America accounts.

Bank Of America Checking Account Bonus 100 300 Cash Promotion

Bank Of America Checking Account Bonus 100 300 Cash Promotion

In other words once you put that money in dont take it out.

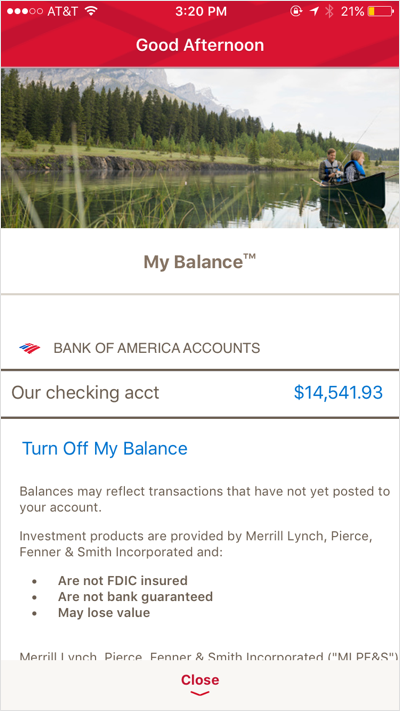

Bank of america checking account minimum balance requirement. Bank of America Core Checking Account has a 12 Monthly Maintenance fee which is waived with at least 1 direct deposit of 250 each month or maintain a minimum daily balance of 1500 or more. You can reach a Bank of America representative at 8004321000 Mon-Fri 8. The monthly service fee is 12 but Bank of America will waive the fee if you have a monthly 250 direct deposit you maintain a 1500 minimum daily balance youre a student less than 24 years old or you enroll in the Preferred.

Sign up for free. Bank of America Interest Checking Account has a Monthly Maintenance fee of 25 which is waived if the balance of all linked accounts is above 10000. The second is to maintain a minimum daily balance of 1500 or more.

This month the banking giant switched e-banking customers into accounts that require a 12 monthly fee unless they have a direct monthly deposit of 250 or more or maintain a. Minimum balances are 20000 for the Gold tier 50000 for the Platinum tier and 100000 for the Platinum Honors tier. Students under age 24 are eligible for waiver of this fee while enrolled in high school college or a vocational program.

That account requires a 12 monthly fee unless customers have a daily balance of at least 1500 or at least one direct deposit of 250 or more. Bank of America is converting all eBanking accounts into its Core Checking product which includes a 12 monthly fee. Enroll in the Preferred Rewards program and qualify for the Gold Platinum or Platinum Honors tier.

The first way to avoid the fee is to have a qualifying direct deposit of at least 250. More than 250000 clients trust WorldFirst. However a general rule is to keep six months of expenses in your savings account in case you lose your job.

Make at least one qualifying direct deposit of 250 maintain a minimum daily balance of 1500 enroll in the. For families this number should be much higher. However with a minimum balance of 10000 or at least four direct deposits into the account youre off the hook.

B there are several ways to sidestep this fee. Simply schedule an appointment visit a financial center or call to speak to a customer service representative. Sign up for free.

Advertentie The smarter cheaper way to transfer money globally. Keep the Change is a Bank of America savings program that works in conjunction with your savings account. The account has a 12 monthly fee unless you meet the following fee waiver requirements every month.

This account setting is designed for individuals and students who want an account with a low minimum balance requirement. Explore our 2019 lower rates. Explore our 2019 lower rates.

When you enroll in this program and make qualifying purchases with your Bank of America debit card well 1 round up your purchase to the nearest dollar amount and 2 transfer the difference from your checking account to your savings account. Advertentie The smarter cheaper way to transfer money globally. To enroll in the Preferred Rewards program you must have an active eligible Bank of America personal checking account and maintain a qualifying balance of at least 20000 for the Gold tier 50000 for the Platinum tier or 100000 for the Platinum Honors tier in your combined qualifying Bank of America deposit accounts such as checking savings certificate of deposit andor your Merrill investment.

Bank of America Advantage Plus Banking. Have at least one qualifying direct deposit of 250 Maintain a minimum daily balance. Its easy to open a checking account for your child who is going to college.

Gallery Short article about savings open opening You wont find a better image of open opening business See why opening business online will be trending in 2016 as well as 2015 Business online current photos taken in 2015 Nice one need more online current number images like this. Bank Of America Checking Account Minimum Balance search trends. More than 250000 clients trust WorldFirst.

Change shifts e-banking customers to accounts that require at least a 250 direct monthly deposit or minimum daily balance of 1500 or more. There are a few ways consumers can avoid the 12 monthly maintenance fee. For most individuals a savings account balance should be between 3000-5000 at minimum.

Maintain a minimum daily balance of 1500or more.