Approximately 3500 have no transaction fee and about half of these also come with no load. The privately held company with over 30 million companies and 74 trillion in total client assets under management offers an extensive collection of products and services for all investor types.

Theyre an easy way to build a low-cost diversified portfolio.

Is investing with fidelity a good idea. That said account options are limited and advisory fees are a bit higher than at some other newer companies. Merrill Edge has far fewer 3500 funds available with less than a thousand carrying no load and no transaction fee. It offers 0 trading commissions a swath of research offerings and an easy-to-use.

But perhaps the biggest advantage is the ability to grow on the platform. So is Fidelity a good broker for a beginner. This article will provide the answer.

The same goes for brokerage firms. Fidelity Investments offers an array of trading and educational tools that many first-time investors will find beneficial. If you want to follow Clarks advice on saving and investing Fidelity is an excellent choice.

As you gain experience you can move over to self-directed investing. Fidelity has a good selection of mutual funds. Legal General has sold its personal investing business worth nearly 6bn to Fidelity in a deal that will add 300000 customers to the new owners client base.

If were talking about Fidelitys Freedom Index funds then yes I like them a lot. Fidelity Investments has a strong reputation for its mutual funds but its brokerage arm is no slouch either. However no restaurant can be all things to all people.

Fidelity offers a true. Theyre a hodgepodge of actively managed funds with significantly higher costs. Fidelity is one of the most popular investment companies in the US.

If you are unsure about the suitability. This can make them ideal for the portion of an investors net worth which is allocated toward funds. Because Fidelity and Vanguard dominated the mutual fund business decades ago mutual funds are naturally still a strong focus for them.

Theres plenty to love about investing with Fidelity. When you are thinking about investing in shares its generally a good idea to consider holding them alongside other investments in a diversified portfolio of assets. For example as a new investor you can start by investing with Fidelity Go.

Along with their state-of-the-art trading platform Fidelity offers among the lowest trading fees in the industry at 495 per trade. Lets take a look at a few of the brokers best features. If however were just talking about Fidelitys Freedom funds ie no index in the name thats a different story.

While other companies may have been in robo-advising longer Fidelity has been in the investing realm for a long time. This information is not a personal recommendation for any particular investment. Comprehensive range of financial products and services.

Here are some of the benefits and services youll enjoy as a Fidelity customer to help you achieve your goals. Whatever youre saving for whether its buying a house starting a business or a long and healthy retirement investing can help bring it a step closer. Similar to any speculative investment buying bitcoin carries some well-known risks.

Especially if youre making standard investments the cons for Fidelity probably seem like nitpicking. It could also be a good fit for investors looking for long-term capital growth. Brilliant and easy website excellent service very good platform with wide range of funds to invest and save.

Therefore FSDIX can be a good choice for retired people who want to buy funds for income purposes. This fund invests mainly in value stocks to produce income in the form of dividends for shareholders. Indeed Fidelity also recognizes the danger that a bad experience with investing could produce so it is providing educational content tools and some guardrails for.

Fidelity Freedom 2050 for example has an expense ratio of 077 as compared to Fidelity. If you like the idea of a robo-advisor firm that is part of a larger company that has years rooted in the investment world you may find Fidelity Go a good fit. Weve spoken to real-life investors who use Fidelity Personal Investing and this is what some of them had to say.

And for good reason. The fund also has a growth objective. The brokers screener returns 11521 products that are open to new investors.

The price could drop precipitously and a single online hacking or. Investors should note that the views expressed may no longer be current and may have already been acted upon. Huge range of funds low fees and expert support Good service website - it would be useful if they provided regular say quarterly market newsletters.

With the availability of investment advice and 247 customer service traders hoping to learn the ropes seem to have good resources here. Fidelitys many different investment services make this possible.

Fidelity Investments Review Self Directed Trading Managed Options

Fidelity Investments Review Self Directed Trading Managed Options

/Fidelityvs.Robinhood-5c61f1a6c9e77c00016626a5.png) Fidelity Investments Vs Robinhood

Fidelity Investments Vs Robinhood

Is Fidelity Good For Beginners Is It A Good Firm To Invest With

Is Fidelity Good For Beginners Is It A Good Firm To Invest With

Seeking Shelter In Volatile Markets Fidelity

Seeking Shelter In Volatile Markets Fidelity

Fidelity Investments Review Pros Cons And Who Should Set Up An Account

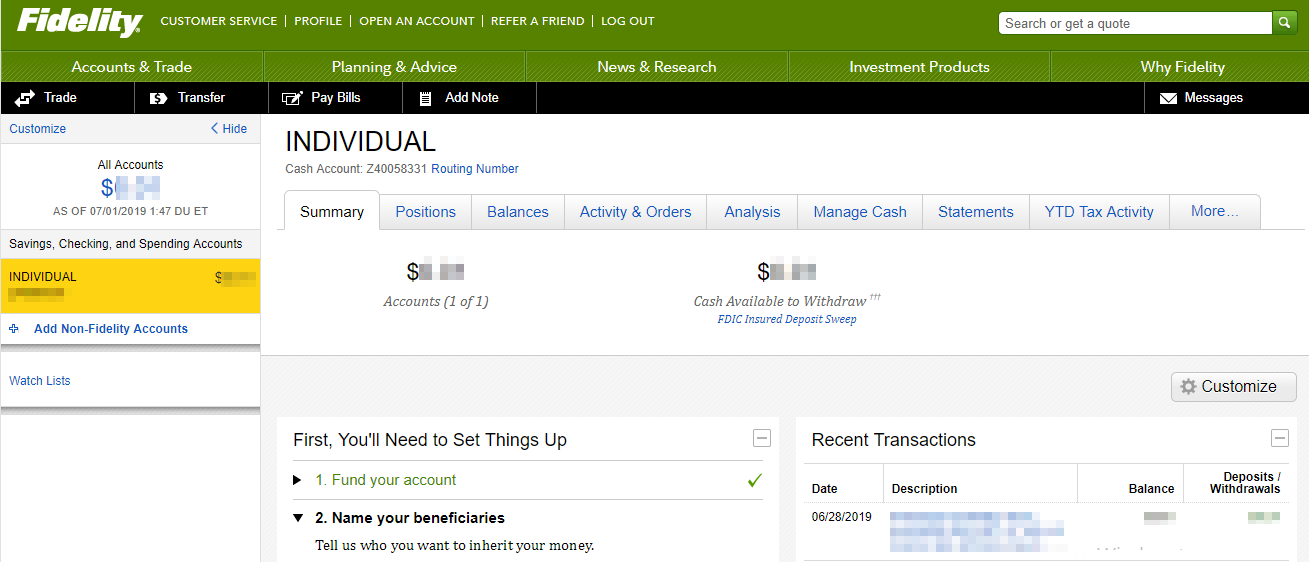

Fidelity Investments By Fidelity Investments

Fidelity Investments By Fidelity Investments

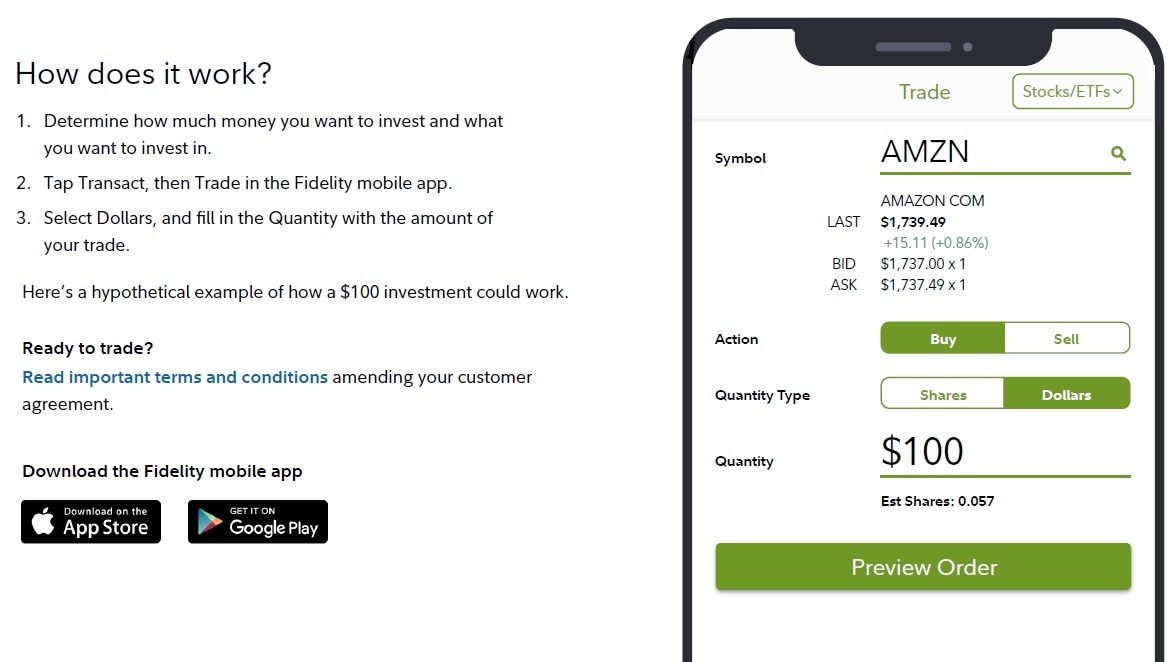

Fidelity Simplifies Investing Again With Launch Of Real Time Fractional Shares Trading For Stocks And Etfs Business Wire

Fidelity Simplifies Investing Again With Launch Of Real Time Fractional Shares Trading For Stocks And Etfs Business Wire

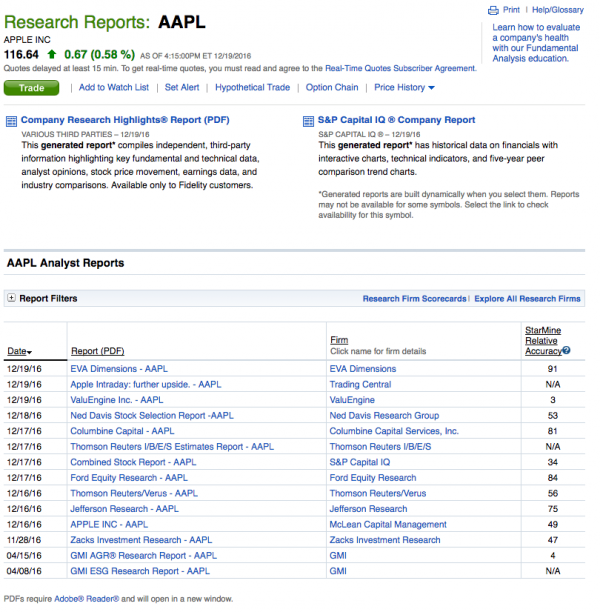

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Investments Review Pros Cons And Who Should Set Up An Account

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Review 2021 Pros And Cons Uncovered

Is Fidelity Good For Beginners Is It A Good Firm To Invest With

Is Fidelity Good For Beginners Is It A Good Firm To Invest With

Fidelity Investments Review 2021 Pros Cons And How It Compares Nerdwallet

Fidelity Investments Review 2021 Pros Cons And How It Compares Nerdwallet

:max_bytes(150000):strip_icc()/ATPCustomLandingPage-0c18be1f4b044e579b3b5a91ed9b0983.png)

:max_bytes(150000):strip_icc()/Fid.comThematicStockScreener-a072ae9b28c24cbabe7a2dcbbb0ad095.png)

:max_bytes(150000):strip_icc()/Fid.comLandingPage-b1a8470d09c34e3db49f1810ac96acf2.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.