Valuation multiples or the price paid per dollar of EBITDA move up and down. Explore the contents of the report here or download the PDF to read the full report.

Private Equity Deal Value Rises In A Crowded Market

Private Equity Deal Value Rises In A Crowded Market

The technical definition of RVPI is the current market value of unrealized investments as a percentage of called capital.

Private equity valuation multiples. If all of your portfolio companies valuations are. AdvantagesDisadvantages of Multiples Disadvantages. Using equity valuation multiple is the quickest way of valuing a company.

4 Private equity valuations 2015 Valuations have gotten more attention because virtually all private equity firms are registered with the SEC and valuations are one of the agencys main areas of focus. Equity multiples by contrast express the value of shareholders claims on the assets and cash flow of the business. Many research studies have demonstrated that on average smaller companies earn higher rates of return than larger companies.

The International Private Equity and Venture Capital Valuation IPEV Guidelines set out recommendations intended to represent current best practice on the valuation of Private Capital Investments. The objectives of these Valuations Guidelines is to set out best practice where Private Capital Investments are reported at Fair Value and hence to help investors in Private Capital Funds. When it comes to calculating an exit valuation the most common and basic formula that is used is Valuation EBITDA x Multiple sometimes EBITDA or profit is substituted for revenue.

This equity valuation method involves comparing the operating metrics and valuation models of public companies with those of target companies. Apart from that it is useful in comparing companies that doing comparable company analysis. Private Equity Valuation Metrics Equity valuation metrics must also be collected including price-to-earnings price-to-sales price-to-book and.

In order to arrive at a more accurate valuation for a small private company we adjust public valuation multiples using published size studies to incorporate a small company risk premium into the large company multiple. Fair value provides a framework for arriving at a Fair Value for private equity and venture capital Investments. They want to see that there is consistency in reporting especially as funds market their own funds.

An equity multiple therefore expresses the value of this claim relative to a statistic that applies to shareholders only such as earnings the residual left after payments to creditors minority shareholders and other non-equity claimants. Numerator Equity Value is the Price per share that shareholders are expected to pay for a single share of the company under consideration. After a few years however the returns turn positive as the portfolio companies are sold.

International Private Equity and Venture IPEV Capital Valuation Guidelines. The three most commonly used valuation methods for private equity transactions are first the Market approach guideline publicly traded company method second the Market approach guideline merged or acquired company method and third the Income approach discounted cash flow method. This article is part of Bains 2019 Global Private Equity Report.

This means that the fund initially posts negative returns because the PE firm is investing money. Denominator Operating parameters like EPS CFS BV etc. Some of the multiples of Equity value multiples are as per below.

The quality relevancy and accuracy of the inputs separate the valuation. Private Equity multiples are calculated by qualified investors to evaluate the performance of private equity funds. Regardless of which method is utilised it is very important to scrutinise the underlying assumptions.

Instantly see how each valuation is calculated including easy-to-understand charts and tables covering valuation multiples such as. Very often private equity funds exhibit a so-called J-curve effect. Yet for the past 30 years the average multiples investors have paid for public assets have almost always topped those paid for private assets usually by as much as one to.

There are a number of criticisms levied against multiples. IPEV board confirms Fair value as the best measure of valuing PE portfolio companies and investments in PE funds II. The RVPI multiple is calculated by taking the net asset.

Do Private Markets Offer More Attractive Opportunities Marquette Associates

Do Private Markets Offer More Attractive Opportunities Marquette Associates

What Does The Next Decade Look Like For Private Equity Investors Marquette Associates

What Does The Next Decade Look Like For Private Equity Investors Marquette Associates

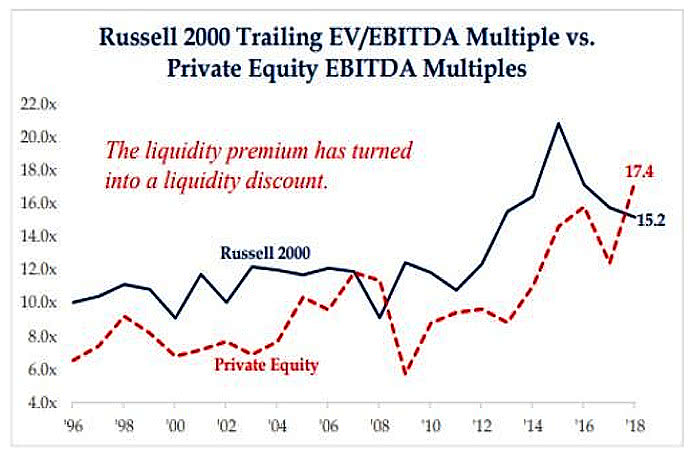

Russell 2000 Trailing Ev Ebitda Multiples Vs Private Equity Ebitda Multiples Isabelnet

Russell 2000 Trailing Ev Ebitda Multiples Vs Private Equity Ebitda Multiples Isabelnet

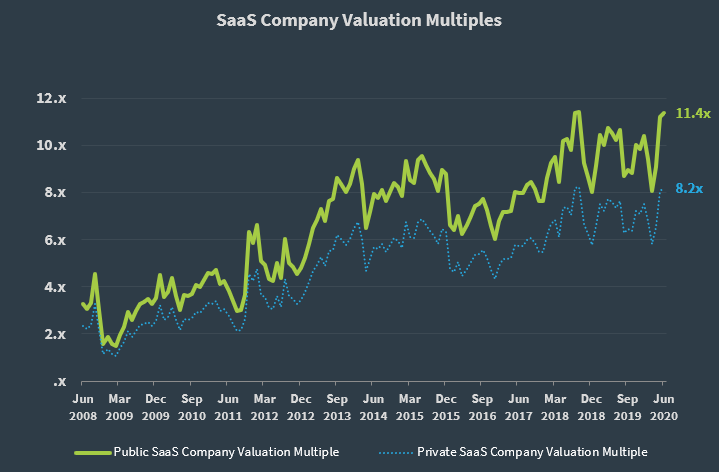

Private Saas Company Valuations Q2 2020 Update Saas Capital

Private Saas Company Valuations Q2 2020 Update Saas Capital

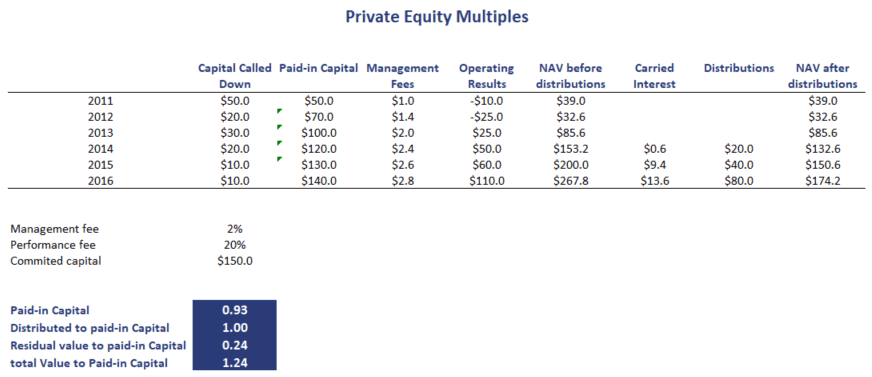

Private Equity Multiples Breaking Down Finance

Private Equity Multiples Breaking Down Finance

Private Equity Outlook Eyewatering Acquisition Multiples Morningstar

Private Equity Outlook Eyewatering Acquisition Multiples Morningstar

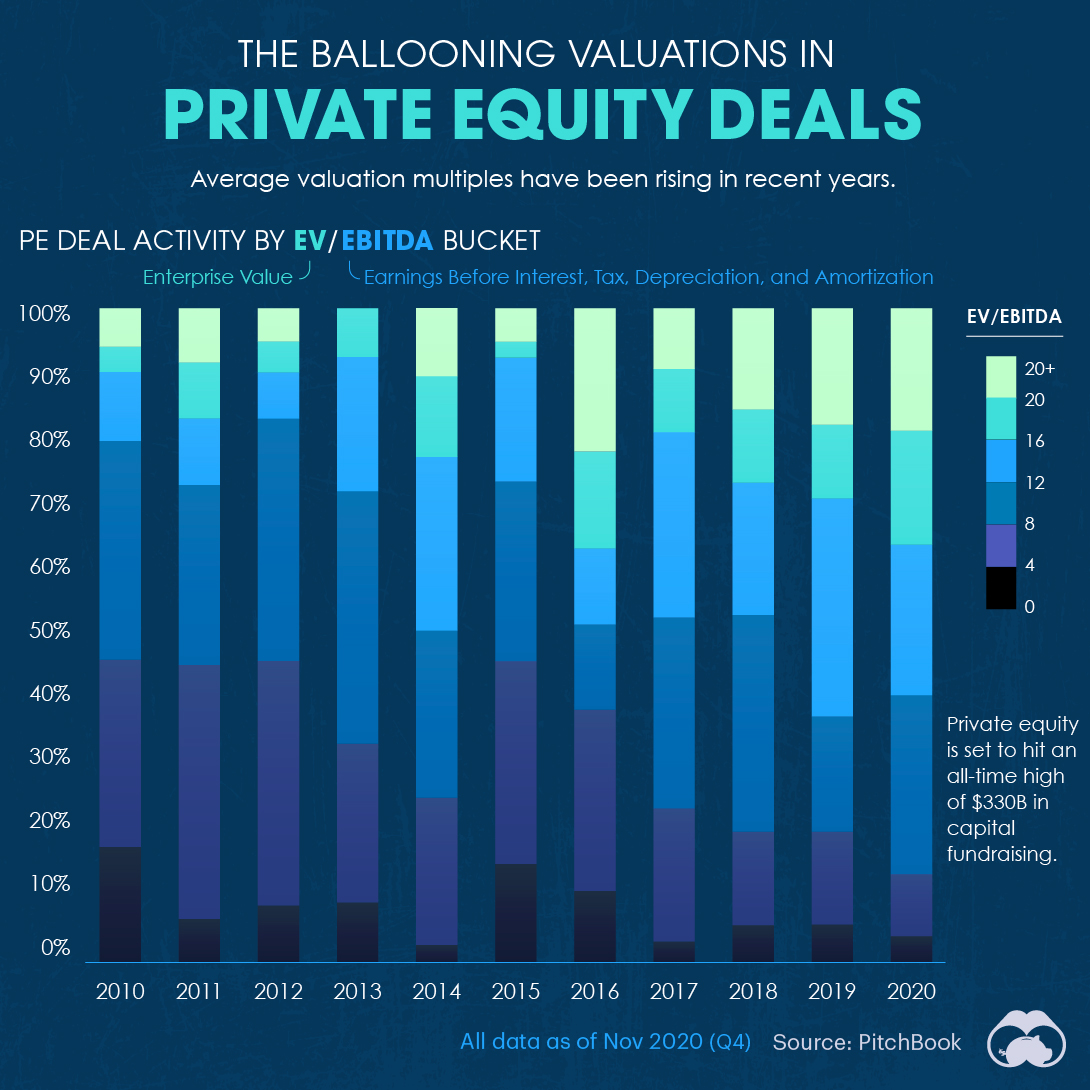

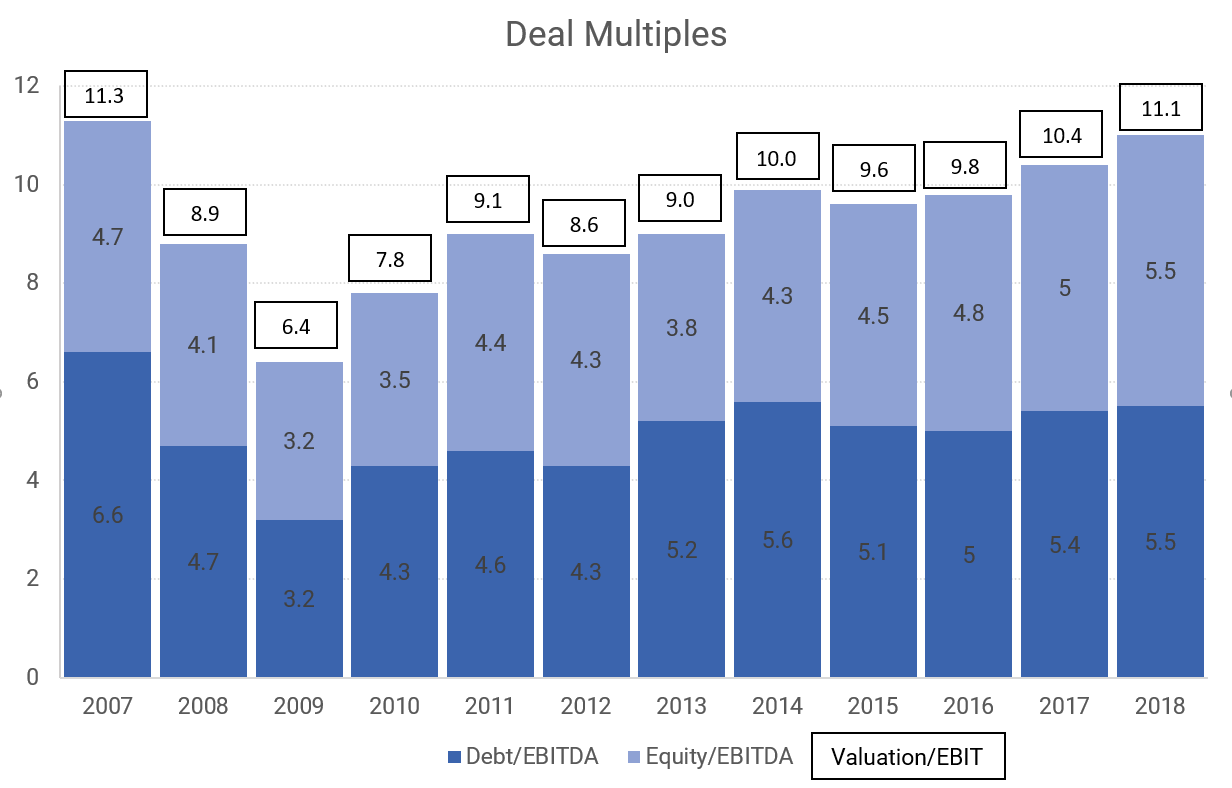

Visualizing The Ballooning Valuations In Private Equity Deals

Visualizing The Ballooning Valuations In Private Equity Deals

Private Equity Deal Value Rises In A Crowded Market

Private Equity Deal Value Rises In A Crowded Market

Have Private Equity Valuations Reached Bubble Levels Intuition

Have Private Equity Valuations Reached Bubble Levels Intuition

Private Equity And Record Buyout Valuations Cause For Concern

Private Equity And Record Buyout Valuations Cause For Concern

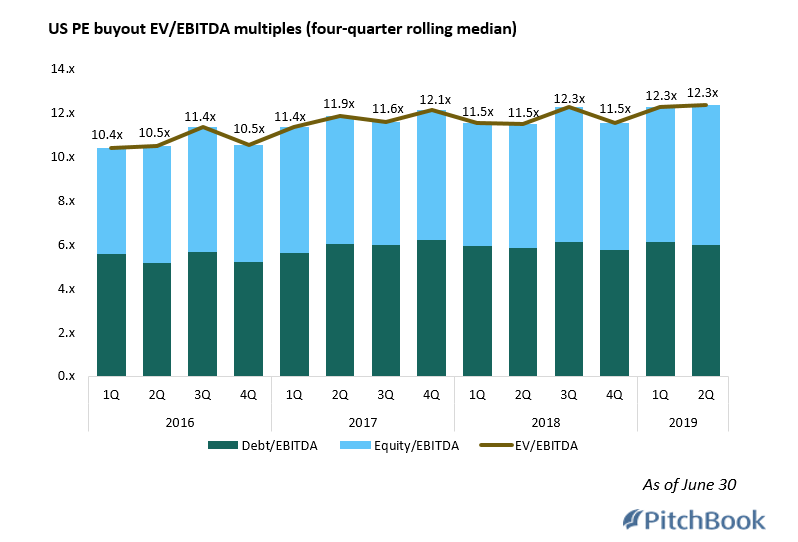

Median Us Pe Buyout Multiples Of 12x May Be The New Norm Pitchbook

Median Us Pe Buyout Multiples Of 12x May Be The New Norm Pitchbook

Using Multiples To Value Companies Edgepoint Com

Using Multiples To Value Companies Edgepoint Com

Europe Private Equity S Last Stand Verdad

Europe Private Equity S Last Stand Verdad

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.