Please enter a valid last name. Compensation methods vary between advisors and retirement plans.

How To Change Your Fidelity 401k Investments Youtube

How To Change Your Fidelity 401k Investments Youtube

Its a nice automated way to build your investment portfolio and of course keeps your money at Fidelity.

Can fidelity manage my 401k. If you use your SSN to log in please create a personalized username for added security. For example Fidelity bills itself as the No. How much does it cost to have an advisor manage your 401 k.

1 recordkeeper of 401 k plans in the United States. I have 401K funds from previous employar and about to move to live abroad so can i rollover my 401k to Merrill edge IRA account and managing it from abroud Amir on August 6 2020 at 1223 am Hi Hui Chen I am moving back to Europe in several months and will not be moving back to US and will lose permanent resident status. Enter a valid email address.

You can put your cash back into the following account types at Fidelity. In addition to the cost ratio I am paying on the various mutual funds I am also paying a quarterly fee to Fidelity that is based on the average balance of the account something like 25 but it is tiered. Please enter a valid first name.

Fidelity Interactive Content Services LLC FICS is a Fidelity company established to present users with objective news information data and guidance on personal finance topics drawn from a diverse collection of sources including affiliated and non-affiliated. Fidelitys BrokerageLink option is a self-directed brokerage account within the 401k or 403b plan. Together with your 401k plan this Plan helps you manage your income tax exposure and gives you an opportunity for added retirement savings Please read the entire Plan Highlights carefully.

Employees your username up to 15 characters can be any customer identifier youve chosen or your Social Security number SSN. In this article youll learn what the BrokerageLink option is and when it may make sense to take advantage of it. If you like me are a set-it and forget-it type of investor a TDF is a good choice.

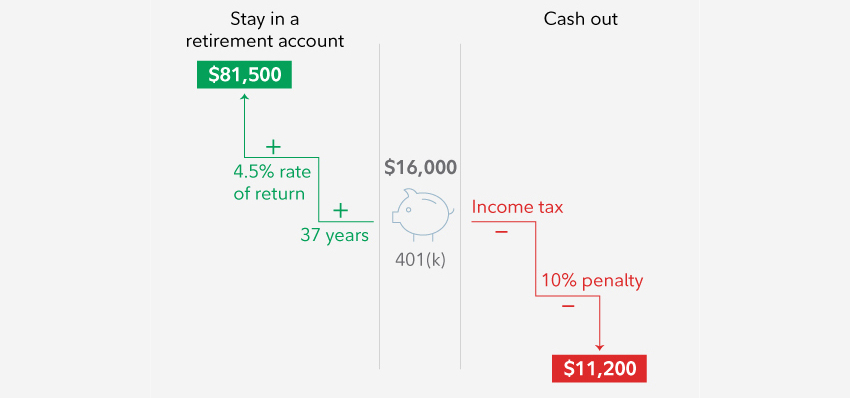

Currently I am paying Fidelity to actively manage the account. Just be aware that many of. You can generally maintain your 401 k with your former employer or roll it over into an individual retirement account.

Please enter a valid last name. If you are one of the 22 million investors with a retirement plan at Fidelity you may have access to an option within your plan that could dramatically improve the success of your 401k. 7 Businesses that use Fidelity report paying as little as 053 in fees though some say.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured regular withdrawals you can set up a budget that will limit your withdrawals to what you need and youll be able to have checks showing up on a set schedule. First name can not exceed 30 characters.

By bringing your old 401ks and IRAs together you can manage your retirement savings more efficiently. The Micron DCP is not a qualified retirement plan such as your 401k plan. At one of the larger 401 k plan providers like Fidelity.

Fidelity 529 College Savings plan. Last name is required. There are also independent providers like FutureAdvisor that can provide recommendations on your 401k plan for free.

It is currently invested in many mutual funds bonds and some index funds. IRAs maintain the tax benefits of your 401 k plan and give you more. A better choice than most people would make for themselves.

Use the Need Help links to the. Fidelity Cash Management Account. SigFig will manage investments in Fidelity TD Ameritrade Institutional or Schwab accounts and will charge a fee of 025 percent of assets under management more than.

You arent forced to put your cash back into a Fidelity account but you can. These pros and cons will help you determine if its for you. Rolling over a 401k is an opportunity to simplify your finances.

If you are a long way from retirement 20 years this is usually a decent choice. The decision to manage your 401k investments should not be made lightly. Last name can not exceed 60 characters.

The Best Fidelity Funds For 401 K Retirement Savers Kiplinger

The Best Fidelity Funds For 401 K Retirement Savers Kiplinger

401k Rollover Options Fidelity

401k Rollover Options Fidelity

Fidelity Viewpoints Five Important Rollover Questions

Fidelity Viewpoints Five Important Rollover Questions

Fidelity Go Review Smartasset Com

Fidelity Go Review Smartasset Com

/CharlesSchwabvs.Fidelity-5c61bb5f46e0fb00017dd690.png) Charles Schwab Vs Fidelity Investments

Charles Schwab Vs Fidelity Investments

What If You Overcontribute To A 401 K Or Ira The Dough Roller

What If You Overcontribute To A 401 K Or Ira The Dough Roller

Fidelity Solo 401k Brokerage Account From My Solo 401k

Fidelity Solo 401k Brokerage Account From My Solo 401k

Fidelity Investments Review Self Directed Trading Managed Options

Fidelity Investments Review Self Directed Trading Managed Options

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

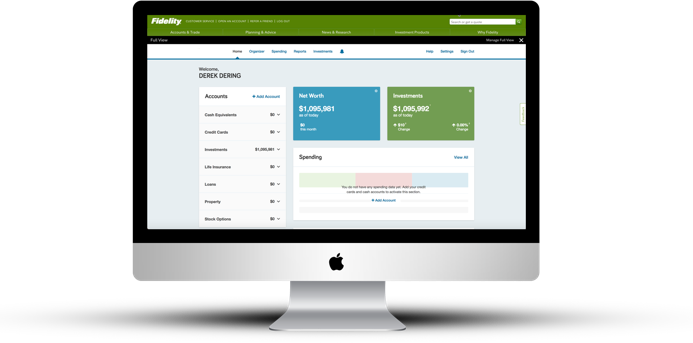

Full View All Your Online Financial Information In One Place Fidelity

Full View All Your Online Financial Information In One Place Fidelity

Fidelity Investments Review Pros Cons And Who Should Set Up An Account

How To Sign Up For A Fidelity Brokerage Account A Step By Step Guide The Motley Fool

How To Sign Up For A Fidelity Brokerage Account A Step By Step Guide The Motley Fool

401k To Rollover Ira New Account Steps Fidelity

401k To Rollover Ira New Account Steps Fidelity

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.